Rising Insurance Rates Got You Down? Here's How Smart Tech Cuts Your Costs

- Savvi

- Sep 2, 2025

- 5 min read

Insurance rates have skyrocketed across the country, with homeowners facing premium increases of 20-45% in recent years. But here's the game-changing reality: smart technology isn't just revolutionizing how we live: it's fundamentally transforming how we protect and insure our homes.

At Savvi, we're leading this transformation by rewarding homeowners who embrace cutting-edge technology with significantly lower premiums and comprehensive protection.

The traditional insurance model is outdated. Instead of simply paying for losses after they occur, forward-thinking insurance companies like Savvi focus on prevention-first strategies that leverage smart technology to eliminate risks before they become expensive claims. This approach doesn't just benefit insurers: it creates immediate, measurable savings for homeowners who invest in smart home technology.

Why Smart Technology Drives Down Insurance Costs

Insurance companies operate on risk assessment. The lower your risk profile, the lower your premiums. Smart home technology fundamentally reduces the three costliest categories of home insurance claims: theft, fire damage, and water damage. When insurers can quantify this reduced risk through real-time monitoring and prevention systems, they pass those savings directly to policyholders.

Enhanced risk management through smart technology creates a win-win scenario. Homeowners gain superior protection and peace of mind, while insurers experience fewer claims and reduced payouts. This mutual benefit explains why the smarter insurance companies are expanding smart home discount programs and offering comprehensive monitoring solutions.

At Savvi, we've taken this concept further by building smart technology integration directly into our modernized insurance approach. We don't just offer discounts for smart devices: we provide concierge-style claims handling that leverages smart technology data to expedite claims processing and ensure accurate assessments.

Game-Changing Smart Devices That Cut Your Premiums

Advanced Security Systems represent the most impactful investment for premium reduction. Comprehensive security solutions featuring smart cameras, motion sensors, doorbell cameras, and automated locks create multiple layers of protection that dramatically reduce burglary and theft risks. Modern systems provide 24/7 monitoring, instant alerts, and remote access capabilities that make properties virtually burglar-proof.

The key advantage lies in real-time threat detection and response. When security systems can immediately alert homeowners and monitoring services to potential intrusions, the likelihood of successful theft drops exponentially. Savvi recognizes this value proposition and typically offers 20%+ discounts for monitored security systems.

Smart Fire and Smoke Detection Systems go far beyond traditional smoke alarms. Advanced systems provide smartphone alerts, automatic emergency service notification, and integration with HVAC systems to prevent smoke circulation. Some cutting-edge models even feature voice alerts that specify the location and type of detected threat.

Early fire detection saves lives and prevents catastrophic property damage. Every minute matters in fire emergencies: smart detection systems that provide immediate alerts can reduce fire damage by 80% or more compared to traditional alarms that only sound locally.

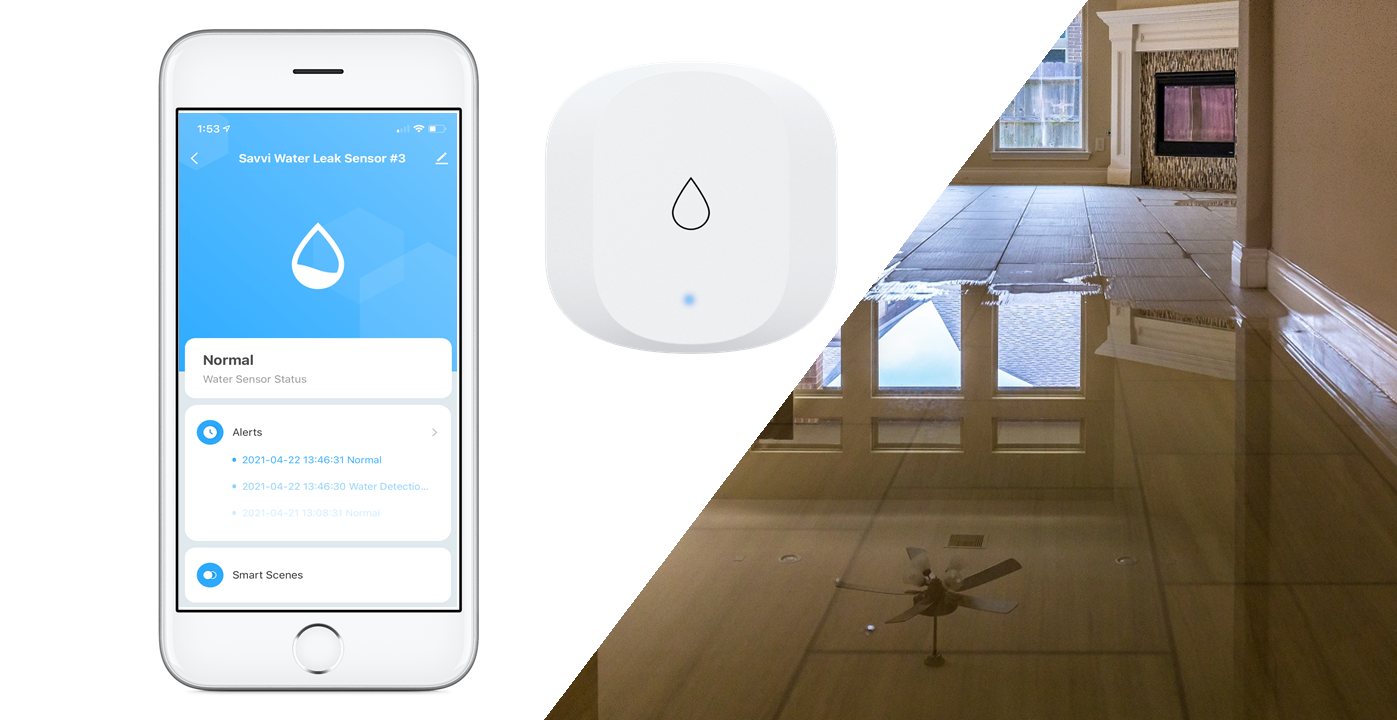

Water Leak Detection and Prevention Systems address one of the most expensive and common insurance claims. Smart leak detectors placed near water heaters, washing machines, dishwashers, and plumbing fixtures can detect even minor leaks before they cause extensive damage. Advanced systems can automatically shut off water supply when leaks are detected, preventing thousands of dollars in potential damage.

Water damage claims average $10,000-$15,000 per incident, making leak prevention systems incredibly valuable to insurers. The return on investment for homeowners is typically realized within the first prevented leak incident.

The Savvi Advantage: Comprehensive Smart Home Integration

Traditional insurance companies treat smart technology as an afterthought: offering modest discounts for individual devices without understanding how integrated systems create exponentially greater protection. Savvi takes a fundamentally different approach by recognizing that comprehensive smart home ecosystems provide superior risk mitigation compared to standalone devices.

Our modernized insurance approach rewards homeowners who invest in integrated smart home solutions that address multiple risk categories simultaneously. When security, fire detection, and water monitoring systems work together, they create a protective ecosystem that can prevent most common insurance claims before they occur.

We provide exclusive benefits for smart home integration, including enhanced coverage options, expedited claims processing using smart device data, and ongoing monitoring support that ensures your protective systems remain optimized. This comprehensive approach goes beyond helping customers save money: it creates a proactive partnership focused on eliminating risks entirely.

Maximizing Your Smart Technology Investment

The key to maximum premium savings lies in strategic device selection and proper documentation. Not all smart devices qualify for insurance discounts, and many homeowners miss significant savings opportunities by failing to communicate their smart home investments to their insurance providers.

Professional monitoring services amplify the value of smart security systems exponentially. While DIY systems provide basic protection, professionally monitored systems that can dispatch emergency services automatically receive the highest insurance discounts. The difference in premium savings often covers the cost of professional monitoring services entirely.

Integration and automation maximize both protection and savings potential. Smart systems that can automatically respond to detected threats, such as shutting off water supplies during leaks or activating security systems when motion is detected, provide superior risk mitigation compared to alert-only systems.

Documentation and communication with your insurance provider ensures you capture all available discounts. Many smart home discounts aren't automatically applied: you must proactively inform your insurer about installed systems and provide documentation of professional installation and monitoring services.

Beyond Discounts: Smart Technology's Hidden Insurance Benefits

Smart home technology provides benefits that extend far beyond premium discounts. Precise loss assessment capabilities help ensure accurate and fair claims handling when incidents do occur. Smart thermostats can provide exact temperature data during frozen pipe incidents. Security cameras provide clear documentation of theft or vandalism. Water sensors can pinpoint when and where leaks occurred.

This data precision speeds claims processing and ensures appropriate settlements. Traditional claims investigations can take weeks or months to determine exact cause and timing of losses. Smart device data often provides immediate, indisputable evidence that expedites the entire claims process.

Enhanced lifestyle benefits create additional value that justifies smart technology investments regardless of insurance savings. Remote monitoring capabilities provide peace of mind during travel. Automated systems improve energy efficiency and reduce utility costs. Smart security features increase overall home value and marketability.

At Savvi, we understand that the best insurance protection combines cutting-edge technology with comprehensive coverage and exceptional service. Our modernized approach to home insurance leverages smart technology to provide superior protection at lower costs while delivering the concierge-style service that every homeowner deserves.

The Future of Smart Home Insurance

The insurance industry is experiencing a fundamental transformation driven by smart technology adoption and data analytics. Forward-thinking companies like Savvi are pioneering prevention-focused insurance models that reward proactive homeowners with significantly lower premiums and enhanced coverage options.

Smart technology integration will continue expanding beyond basic monitoring to predictive analytics that can identify potential problems before they occur. Machine learning algorithms will analyze patterns in smart device data to predict when appliances might fail, when maintenance is needed, or when weather conditions create elevated risks.

Everyone we insure benefits from this technological evolution through lower costs, better protection, and superior service. The future of home insurance lies in partnerships between homeowners, technology providers, and innovative insurance companies committed to preventing losses rather than simply paying for them after they occur.

Rising insurance rates don't have to be inevitable. Smart technology provides a proven pathway to lower premiums, enhanced protection, and greater peace of mind. At Savvi, we're committed to rewarding the benefits of a smarter, better protected home with comprehensive coverage solutions that recognize the value of prevention-first thinking.

Get in touch with us or contact your agent today to learn more.www.sosavvi.com

About Us

Savvi Insurance Group, Inc., based in Charlotte, North Carolina, is committed to helping families and individuals prevent losses, stay safe and protect the people and things they love. We do that by providing our customers with our cutting-edge smart home security system along with a suite of services and benefits designed to proactively predict and prevent losses from happening in the first place. We then back that up with comprehensive, modernized insurance protection and concierge-style claims handling, at prices that recognize and reward the benefits of a smarter, better protected home.

Savvi is backed by financially secure insurance companies that have earned A-ratings from A.M. Best which means your policy is secure no matter what happens. For more information, visit www.sosavvi.com

Comments